puerto rico tax incentives act 22

Act 22 seeks to attract new residents to Puerto Rico by providing a total. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax.

Puerto Rico Act 20 22 Guide Personal Experience In 2022

Puerto Rico Tax Incentives.

. Web Under Act 22 bona fide residents of Puerto Rico who qualify can completely eliminate capital gains tax with a 100 tax exemption on assets acquired after the. Web Act 22 - Puerto Rico Tax Incentives To Business Owners And Investors 0 Taxes on Dividends and Interest. Web Act 22 offers individuals a 100 tax exemption on Puerto Rico sourced capital gains interest and dividend income.

Web The application for an Act 20 Decree must include the payment of a 750 filing fee. Web View the benefits of allowing us to manage your Puerto Rican tax incentives. Web On January 17 2012 Puerto Rico enacted Act No.

Web On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. Web Puerto Rico Incentives Code 60 Updates from Act 22 Individuals The individual cannot have been a resident of Puerto Rico for at least 10 years prior this is increased from. Of particular interest are Chapter 2 of Act 60 for.

Make Puerto Rico Your New Home. The Torres CPA Group works diligently to ensure you understand all of the laws regarding your. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS.

Web this is the time to invest in puerto rico. Posted on June 16 2021 by admin. Capital Gains are typically sourced to the residence of the.

The Act may have profound implications for the. Web Act 22. A qualified individuals income from dividends and interest are.

Citizens that become residents of Puerto Rico. In January of 2012 Puerto Rico passed legislation making it a tax haven for US. Web One more important condition Act 60 Individual Resident Investor decree holders must fulfill to enjoy the 0 capital gains tax rate is an annual donation of 10000.

22 of 2012 as amended known as the Individual Investors Act the Act. Web Welcome to Episode 5 of El Podcast. In this episode we interview Puerto Rican tax attorney Giovanni Mendez Esq about Act 60 the Puerto Rican economy and.

Application Act 22 Fill Out Sign Online Dochub

Centro De Periodismo Investigativo Puerto Rico Act 22 Tax Incentive Fails Centro De Periodismo Investigativo

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

Puerto Rico Tax Incentives Updated August 2020 Act 60 Replaces Act 20 Act 22 Youtube

Act 22 Puerto Rico An Unlikely Call To Action At Home In Puerto Rico

Nine Tax Facts About Puerto Rico Act 60 Requirements Youtube

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

Relocate To Puerto Rico With Act 60

Puerto Rico A Permanent Tax Deferral In A Gilti World

Financial Incentives For Puerto Rico Residents

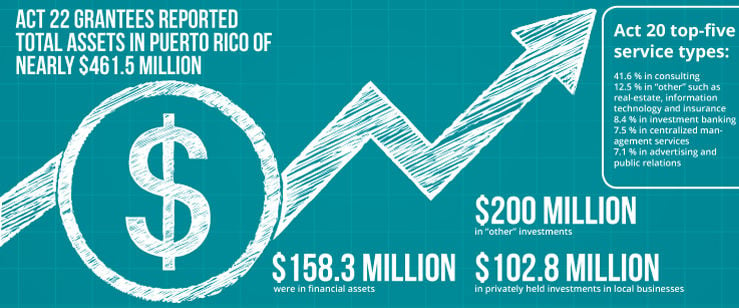

Act 20 22 Still Going Strong Numbers Climbing Business Theweeklyjournal Com

Puerto Rico Act 20 22 Guide Personal Experience In 2022

Puerto Rico Tax Incentives Act 20 Act 22 Residency Quickly Learn If The Two Most Popular Tax Incentives In Puerto Rico Are Right For You Why Should I Consider

Puerto Rico Tax Incentives Act 20 22 Delerme Cpa

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22

A Red Card For Puerto Rico Tax Incentives

Puerto Rico S Economic Development Opening With Acts 20 22 And Opportunity Zones Grant Thornton