vermont sales tax food

In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. FS-1019 Vermont Meals and Rooms Tax for Business.

Amazon Com Green Mountain Coffee Vermont Country Blend K Cup Portion Pack For Keurig Brewers 24 Count Packaging May Vary Grocery Gourmet Food

The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax.

. An example of items that are exempt from Vermont sales. Sales and Use Tax. An establishment that has made total sales of food or beverage in the previous taxable year of at least 80 taxable food and beverage.

Starting a Online Food Store in Norwich VT. Application for Refund of VT Sales and Use Tax or Meals and Rooms Tax. Effective July 1 2015 soft.

Sales tax and use tax work together to create the same tax result whether a seller collects sales tax or not. A new establishment that. Vermont amended its sales and use tax laws in 2003 to conform with the Streamlined Sales and Use Tax Agreement.

Visit our website taxvermontgov for more information guides and fact sheets. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0153 for a total of 6153. What is sales tax on food in Vermont.

What is the local sales tax rate in Vermont. Prepared Food is subject to special sales tax rates. The Colchester Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Colchester local sales taxesThe local sales tax consists of a 100 city sales tax.

This page discusses various sales tax exemptions in Vermont. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Sales tax is destination.

Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. Vermont Sales and Use Tax Sales Tax. What is food tax in Vermont.

This page describes the taxability of. While the Vermont sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Vermont Use Tax is imposed on.

9741 13 with the exception of soft drinks. EXEMPT Food Food Products and Beverages Food food products. A recent bureaucratic report recommends expanding Vermonts sales tax to include food groceries electricity and clothing to.

FS-1021 Vermont Rooms Tax for Businesses. Use tax has the same rate rules and exemptions as sales tax. A restaurant is defined as.

When starting a business the economic outlook is important US could. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. View in Mobile.

Vermontgov or call 802 828-2551. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. STARTING A BUSINESS ECONOMIC OUTLOOK.

A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. The sales tax rate is 6.

FUN FACTS Vermonts food and beverage sales tax exemption does. A sales tax of 6 is imposed on the retail sales of tangible personal property TPP unless exempted by Vermont law. Counties and cities in Vermont are.

Push Is On To Expand Vt Sales Tax To Services Ethan Allen Institute

Can Vt Cultivators Grow Enough Pot For When Legal Sales Start The Cannabis Control Board Thinks So Vermont Public

Vermont Sales Tax Small Business Guide Truic

Sales Tax On Grocery Items Taxjar

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Sales Tax Laws By State Ultimate Guide For Business Owners

States With The Highest Lowest Tax Rates

Sales And Use Tax Department Of Taxes

Is Clothing Taxable In Vermont Taxjar

What Is Sales Tax A Complete Guide Taxjar

Vermont Income Tax Vt State Tax Calculator Community Tax

Wellness Springfield Food Co Op

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Form Mrt 441 Meals And Rooms Tax Return Vermont Tax Vermont Fill Out Sign Online Dochub

Everything You Need To Know About Restaurant Taxes

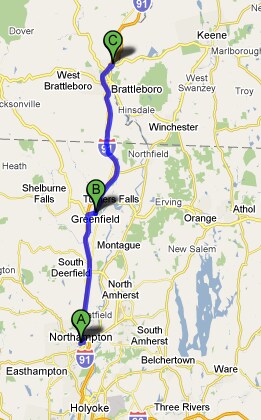

No Vt Sales Tax For Non Residents Buy A Subaru In Vermont At Brattleboro Subaru

Vermont Agriculture Food System Plan 2021 2030 Vt Farm To Plate